Trust losses: Keeping them in the family

August 5, 2021Who can (and can’t) be part a family group for the purpose of making a family trust election (FTE)?

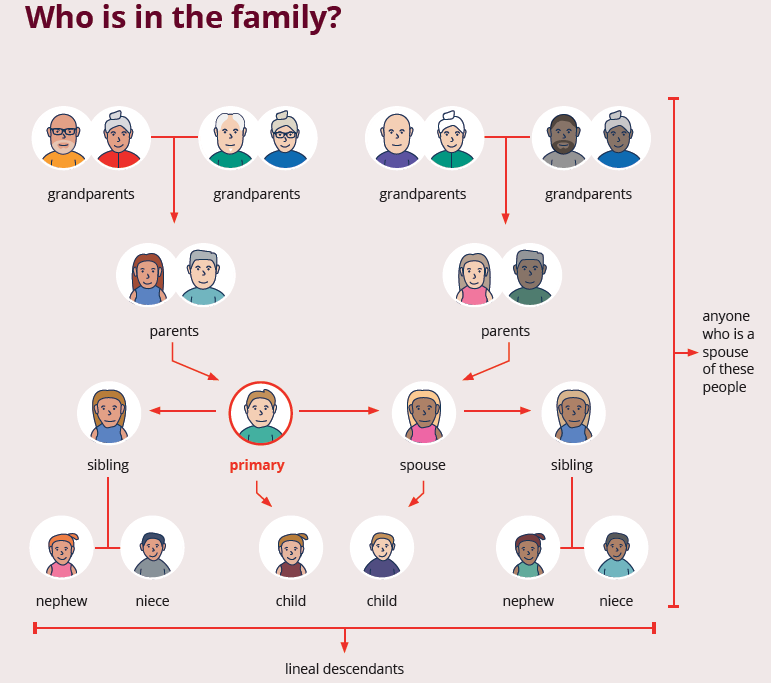

As you can see by the diagram below, the ‘family group’ is dependent on the choice of the ‘test individual’. Once that person is chosen, the family group includes the person’s spouse, plus any of their children, grandchildren, parents, grand- parents, brothers, sisters, nephews, or nieces. The spouses of any of these people are also included.

The family group can include a de facto spouse, stepchildren and half-brothers and half-sisters, but not aunts and uncles, cousins, great-grandchildren, or stepbrothers and stepsisters. The spouse of a deceased test individual will continue as a member, but not if they partner up again. And where a married test individual is divorced, the family group membership of their former spouse is ended. However, the former spouse is still in the family group in relation to distributions.

Importantly, if the test individual dies, the trust remains a family trust and the family group continues to be worked out by reference to the test individual.

Where an FTE is made, the rules that limit the deductibility of prior year and current year losses and bad debt deductions are much less onerous. Only the income injection rule applies, and then only where a person outside the family group is involved. Otherwise, there is also a 50% stake test, a control test and a pattern of distribution test that have to be satisfied.

Having an FTE also relaxes the company loss tracing rules, the holding period governing access to franking credits and the application of the trust beneficiary reporting rules.

Keep the diagram handy when confirming who the beneficiaries of a family trust can be, without paying family trust distributions tax.

Note:

- “Child”,”parent” and “spouse” are defined terms.

- A person does not cease to be a family member merely because of the death of any other family member.

- An adopted child, step-child or ex-nuptial child of a person is taken to be lineal descendant of that person for the purpose of determining the lineal descendants of that person or any other person.

This information has been prepared without taking into account your objectives, financial situation, or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation or needs. Content in partnership with Taxpayers Australia